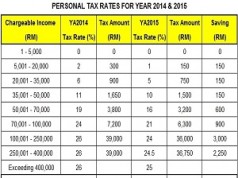

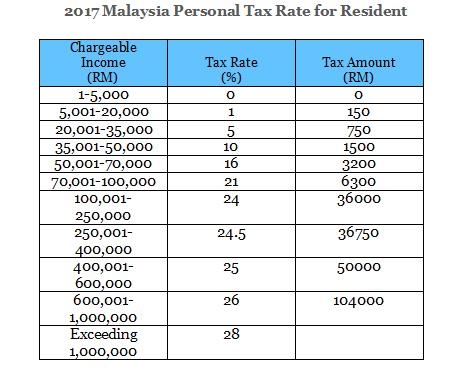

They all refer to the tax tables whether in whole or as specific sectionscategories of the tax tables therein. For all other back taxes or previous tax years its too.

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

This booklet also incorporates in coloured italics the 2022 Malaysian Budget proposals based on the Budget 2022 announcement on 29 October 2021 and the Finance Bill 2021These proposals will not become law until their enactment and may be.

. Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs. The general income tax base comprises all categories of taxable income ie. This publication is a quick reference guide outlining Malaysian tax information which is based on taxation laws and current practices.

For example you have until April 15 2024 to claim a 2020 Tax Refund April 15 2023 to claim 2019 Tax Refund and for 2018 until April 18 2022. Malaysia Tax Tables may also be referred to as Malaysia Tax Slabs Malaysia personal allowances and tax thresholds or Malaysia business tax rates. In the section we publish all 2022 tax rates and thresholds used within the 2022 Malaysia Salary Calculator.

Tax allowances expenses and. Average Lending Rate Bank Negara Malaysia Schedule Section 140B. As of 1 January 2019 individuals who derive in a tax year income exceeding PLN 1 million are required to pay solidarity tax at the rate of 4 on the excess of this amount.

Income from employment business and capital. Be aware that you can only claim your tax refund for a previous tax year within three years of the original tax returns due date or deadline. The Norwegian income tax system for individuals is based on a dual tax base system.

An obligation of submitting a separate tax declaration by 30 April of the following tax year will also apply. This was highlighted in the revised Guidelines for Application Of Approval Under Subsection 446 Of The Income Tax Act 1967 dated 15 May 2019. General income and personal income.

According to the document organisations are requested to issue official tax exemption receipts only for donors who have provided all required particulars. A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer an individual or legal entity by a governmental organization in order to fund government spending and various public expenditures regional local or national and tax compliance refers to policy actions and individual behaviour aimed at ensuring that taxpayers are paying the right amount. General income is taxed at a flat rate of 22.

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

Malaysia Personal Income Tax Rates 2013 Tax Updates Budget Business News

Malaysia Personal Income Tax Rates 2013 Tax Updates Budget Business News

Individual Income Tax In Malaysia For Expatriates

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Personal Tax Relief Malaysia 2019 Madalynngwf

Here S 5 Common Tax Filing Mistakes Made By Asklegal My

Malaysia Personal Income Tax Rates Table 2010 Tax Updates Budget Business News

Lhdn Irb Personal Income Tax Relief 2020

Malaysia Personal Income Tax Guide 2021 Ya 2020

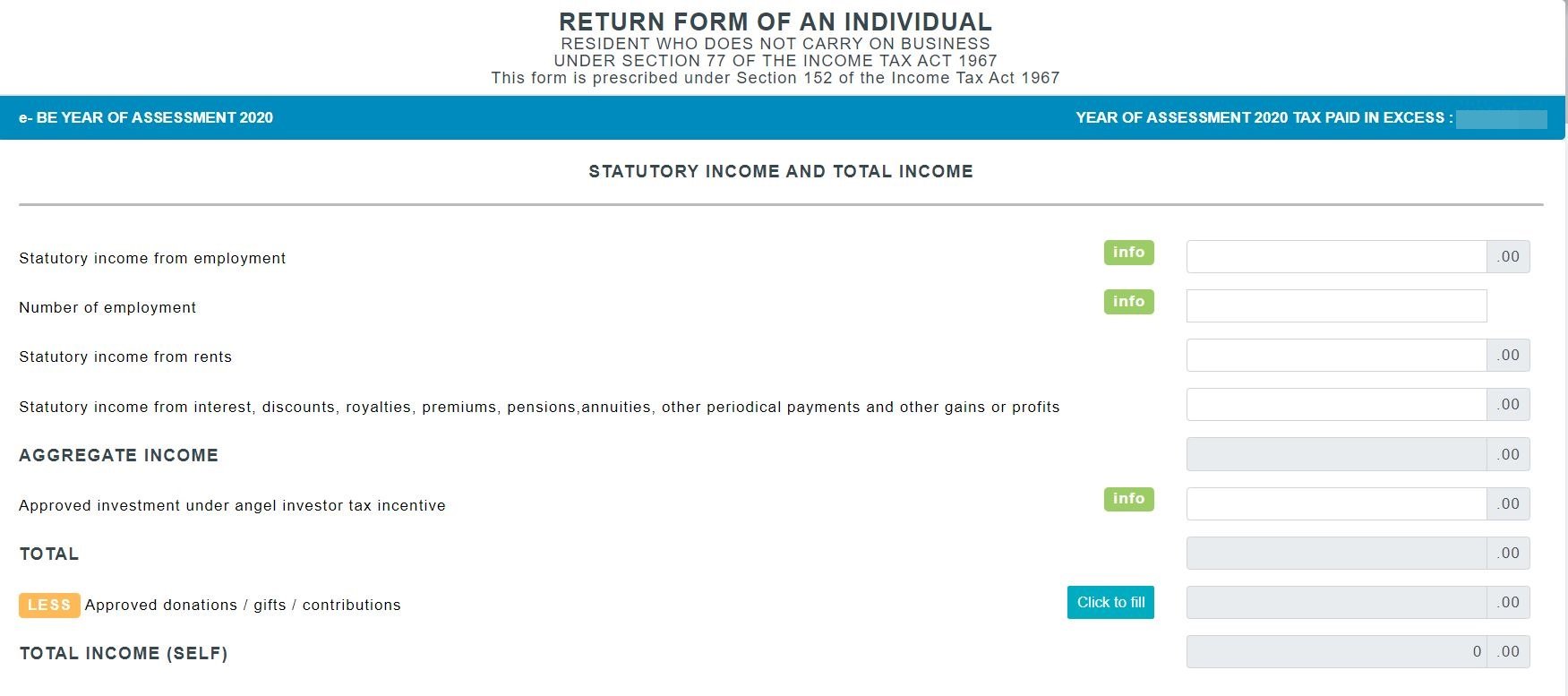

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Malaysia Personal Income Tax Rates Table 2011 Tax Updates Budget Business News

Malaysia Personal Income Tax Calculator Malaysia Tax Calculator

10 Things To Know For Filing Income Tax In 2019 Mypf My

Lhdn Irb Personal Income Tax Relief 2020

Malaysia Personal Tax Relief Ya 2019 Cheng Co Group

Borang Tp 1 Tax Release Form Dna Hr Capital Sdn Bhd

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Download Kwsp Income Tax Relief 2019 Gif Kwspblogs